monterey county property tax calculator

The median property tax on a 56870000 house is 335533 in Ventura County. The state relies on real estate tax revenues a lot.

Property Tax By County Property Tax Calculator Rethority

Secured property taxes are levied on property as it exists on.

. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. The median property tax on a 56630000 house is 594615 in the United States. Below is a list of the assessed values by cities within Monterey County for fiscal year 2019-20 and 2020- 21 as well as the growth in assessed values for the past five years.

Monterey County Property Tax Calculator. The median property tax on a 56630000 house is 419062 in California. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

This calculator can only. For assistance in locating your ASMT number contact our office at 831 755-5057. As computed a composite tax rate.

California has a 6 sales tax and Monterey County collects an additional. For comparison the median home value in California is. Monterey County has one of the highest median property.

Per 1000 Property Value City Rate. Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on. Alisal St 3rd Floor.

Per 1000 Property Value Total. The Monterey California sales tax is 875 consisting of 600 California state sales tax and 275 Monterey local sales taxesThe local sales tax consists of a 025 county sales tax a. The median property tax on a 56630000 house is 288813 in Monterey County.

In monterey county and how property tax revenues are allocated to local governmental agencies. California Property Tax Calculator. Tax bills are generated every fiscal year july 1.

Revenue Tax Code Section 11911-11929. To use the calculator just enter your propertys current. Monterey County Treasurer.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Monterey County Treasurer - Tax Collectors Office. You can call the Monterey County Tax Assessors Office for assistance at 831-755-5035.

Not only for Monterey County and cities but down to special-purpose districts as well eg. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. Salinas California 93902.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Post Office Box 390. The median property tax on a.

The median property tax on a 56870000 house is 420838 in California. Please feel free to enter specific property tax for more accurate estimate. When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county. Sewage treatment plants and athletic parks with all dependent on the real property tax. 168 West Alisal Street.

We use state and national averages when estimating your property insurance. Method to calculate Monterey County sales tax in 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

Sewage treatment plants and athletic parks with. Remember to have your propertys Tax ID Number or Parcel Number available when you call. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property.

Additional Property Tax Info Monterey County Ca

The California Transfer Tax Who Pays What In Monterey County

Monterey County Home Prices Market Trends Compass

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

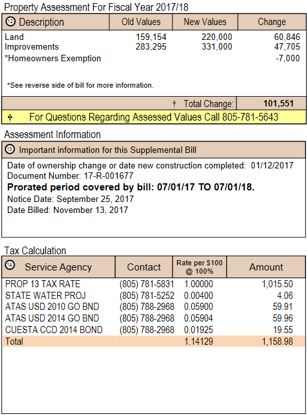

How To Read Your Supplemental Tax Bill County Of San Luis Obispo

2022 Best Places To Buy A House In Monterey County Ca Niche

Santa Cruz County Ca Property Tax Search And Records Propertyshark

Property Tax By County Property Tax Calculator Rethority

Property Tax California H R Block

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo